Explaining the changes we’re making

What’s happening

We are moving away from our life company, called FIL Life Insurance Limited, and becoming a MiFID* investment firm. This will be called FIL Platform Solutions (UK) Limited (or FPSL).

As part of this change, we will introduce a new charging approach. This will make it easier for members of our workplace pension schemes to understand how much they’re paying us in charges for managing their retirement savings.

The current approach to charging

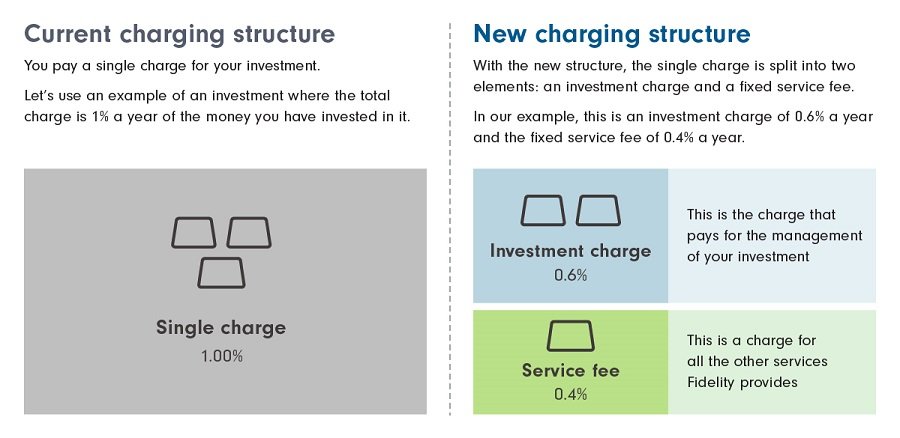

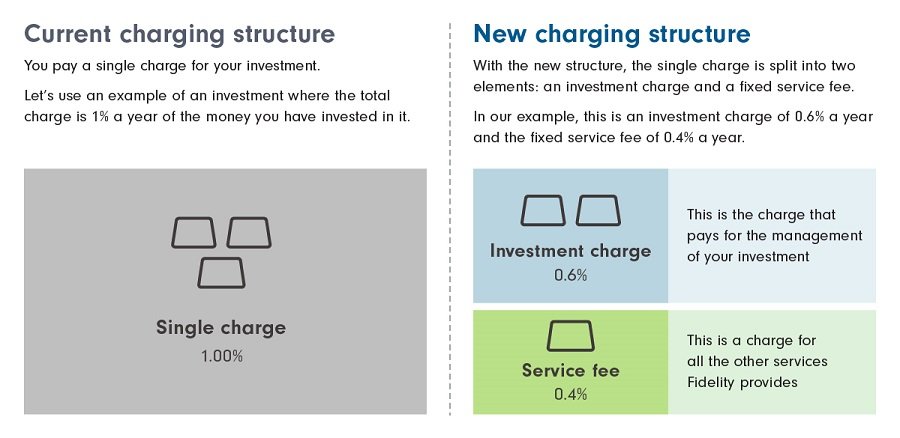

Each investment currently has an ongoing charge (shown as a single Total Expense Ratio (TER)). It is partially paid to the company that manages the investment and partially paid to us for the services we provide. The charge is built into the daily unit price of the investments. This means your pension savings’ investment performance is based on the returns they achieve, after charges are taken out.

The new approach to charging

We will be splitting the current charge into two parts:

- An investment charge that pays for each underlying fund’s investment management and is set by the company that runs the investment. This charge will still be built into the daily unit price, so is still taken directly from the investment’s value.

- A service fee, which is set by and paid to us for all the services we provide. These include offering a wide range of investment options, administering your accounts and ensuring the safe custody of your savings. This is shown as a percentage fee and will be taken as a separate monthly charge from your pension account. It will be clearly shown in your online pension account in PlanViewer and on your annual benefit statement.

What won’t change

Each investment incurs transaction costs, which cover the costs involved in buying and selling its underlying investments. These are included in the investment price as well.

* Markets in Financial Instruments Directive. Please see the 'Questions and answers' section for more details about this.

Please note that the example below is purely for illustrative purposes and is not a reflection of the actual charges in your pension scheme.

The default strategy

We have set our service fee at a level that ensures anyone using the default investment strategy will pay the same total cost for their pension as they do under the current charging structure. This includes the service fee and investment charge.

The self-select range

The charge for our services in the current charging structure varies from investment to investment as part of their total cost. With the new charging structure, the service fee will be a fixed percentage charge for your entire pension plan. This means you pay the same service fee for all the self-select investments on offer (which is also the same as the service fee for the default investment strategy).

As a result, the total cost for some self-select investments will be slightly less and others will be slightly more under the new charging approach. We have outlined what the changes mean for you from a cost perspective in the email or letter that accompanies this guide.

- Is fully invested in the default investment strategy

- Will be paying the same total cost for his pension as he does now

- Uses the self-select range

- Will be paying broadly the same total cost, or less, for her pension as she does now.

- Uses the self-select range

- Will be paying more in total costs for her pension than she does now

What we offer for your service fee

1 Source: Trustpilot Official website - https://uk.trustpilot.com/review/www.fidelity.co.uk

2 Source: Boring Money Best Buy Pension, as at February 2024. The Boring Money Best Buy Pension award is designed to recognise the best Self-Invested Personal Pension (SIPP) providers in the UK.

3 Source: Corporate Adviser, as at June 2024. The Corporate Adviser Awards recognise excellence and innovation in the delivery of workplace benefits advice, consultancy, products and services. They are the leading awards for the workplace benefits community.

The process

The process will start on the date set out in the email that accompanies this guide. It will then last up to three weeks.

The Trustees have told us that they have taken legal advice on this change and have approved what we are planning.

Recent changes in the regulations have opened up new opportunities for pension companies. We are introducing this new structure to take advantage of them, while keeping our current workplace pension benefits.

No, you won’t be able to use your account while the changes are taking place. This means you will not be able to make any alterations to your pension account or carry out any transactions, such as withdrawals, transfers or additional contributions. You will still be able to log in to PlanViewer and view your account during this time.

There may be a double payment before the transition starts. This will cover the regular monthly payment and the payment that would otherwise be missed during the transition, as we can’t make withdrawals while it is happening.

If you are in this position, you may be charged more tax than usual by HMRC on the payment. You should then receive an automatic tax rebate in a later month’s payment. Alternatively, if you do not have any further payments planned for this tax year, please contact HMRC to claim this rebate directly. Your withdrawal confirmation letter will explain how to do this and you can also find out more at www.gov.uk/claim-tax-refund

We are not charging anything for handling the transition to FIL Platform Solutions (UK) Limited. Any costs resulting from this legal entity change will be met by Fidelity, including any transaction costs.

There are some investments that may become more expensive following the transition. For members in these investments, we will cover any costs associated with changing investments. This is outlined in section 1 of the email and/or letter that accompanies this Guide and FAQ. Please read it to see whether Fidelity will cover any one-off transaction costs involved in selling or buying investments.

The answer to this question depends on the accounts that you have:

- If you have more than one pension account with the same employer, the changes will be applied at the same time.

- If you have pension accounts with different employers (and they are all managed by us), the changes are likely to be applied at different times.

The communication you received with this guide will tell you which pension account it refers to and give you details of the timings and service fee for that scheme.

You may notice you have a different number of units in each investment within your pension after the transition. This is because we need to move your money into new versions of the investments. These will be held directly by the Trustees on your behalf rather than through an insurance policy. The pounds and pence value of your investments won’t be affected by this change.

The new approach to charging

You can find the new service fee within the new ‘Your Plan Explained’ document that was provided in the email or letter that accompanies this guide. After the transition is complete, the service fee will be shown in PlanViewer on the ‘Fees and charges’ page. This is in the ‘Forms and literature’ section.

The service fee will be deducted from your pension account every month, and you will see this transaction on your statements. You can also find the service fee in the costs and charges tool on our website and by logging in to PlanViewer.

The service fee is calculated based on the value of your pension plan on the last day of the previous month. It is then collected the following month. For example, the service fee for May will be collected in June, with the calculation based on the value of your pension plan at the end of April.

If your pension currently receives contributions in more than one way or did so in the past, you will see multiple service fees on your pension. This includes contributions such as employer contributions, employee contributions and additional voluntary contributions you make yourself.

There will be one service fee for each contribution type. It will be taken from the investment you have the most money in for that contribution type. The total amount you pay will still be the same as if you only made one type of contribution.

We will take the service fee on or around the same date each month. You can check this date in your new ‘Your Plan Explained’ document and on PlanViewer, as the monthly deductions will show in your ‘Transaction history’.

While we are withdrawing the service fee, you will not be able to make any investment changes (or withdrawals) in your account. This will typically last 24 hours until the service fee withdrawal is complete. When it is finished, you will then be able to log into your account and make any changes you want to. For example, if your service fee deduction date is 31 March, you would typically not be able to change your investments at any point during this day.

The change in legal entity

MiFID, or the Markets in Financial Instruments Directive to use the full name, is a set of rules for investment companies. They include a focus on transparency and investor protection. A MiFID investment firm is a company that has been set up to follow these rules.

We know that talking about ‘safety’ when it comes to pension savings can sound worrying. That’s why we want to start by saying that the companies involved in looking after your money are all large, well-run businesses that are very unlikely to get into financial difficulties. In our opinion, the change in legal entity does not affect the security of your pension plan. Fidelity is authorised and regulated by the Financial Conduct Authority. This requires having the appropriate systems and controls to manage its business, including adequate financial soundness.

While the protection for your savings will work slightly differently under our new corporate structure, the end result will be broadly the same. We believe the circumstances in which you would not receive the full value of your pension saving are very unlikely to occur.

The Financial Services Compensation Scheme rules apply for both the old and new legal entities.

If you are currently employed by the company offering this scheme, you can choose to transfer the money in your account to another registered pension provider. You will continue to receive ongoing pension contributions from your employer that will be paid into your pension account.

You can also consider opting out. If you do this, you will lose the right to a pension contribution from your employer, so you may have a lower income when you retire. You may also lose other benefits that your employer provides that are linked to membership, such as any lump sum or pensions payable in the event of your death while employed. We recommend you speak to your employer for further details and consider taking financial advice before you start a transfer.

If you are no longer employed by the company offering this scheme, you can choose to transfer the money in your account to another registered pension provider. Any transfer out of your pension is free of charge. However, you may wish to check whether the plan or arrangement receiving the transfer will charge you.

In both cases, you can find more information about transferring on our website at: retirement.fidelity.co.uk/about-workplace-pensions/transferring-savings

If the transfer hasn’t completed before the transition to FIL Platform Solutions (UK) Limited starts, there will be a block on your workplace pension while the transition takes place. The transfer will then continue again once the transition is done. If you are transferring away from us, your pension will be subject to the new charging approach from this point until the transfer is complete.

- If you want to make single/one-off contributions directly, and not through your employer, you will need to call us to do this. Our bank account details are changing, so you won’t be able to use the bank details you’ve used in the past.

- If you are using drawdown to take an income from your pension, you will see a couple of small differences after we change the legal entity. Your payslips will be sent from the Trustees (instead of FIL Life) and there will be a change in the payroll reference on them.

| Quick tip: If you’re not familiar with the term ‘single/one-off contributions’, you may also know them as additional, lump sum or ad hoc contributions, AVCs or one-off payments. They are payments you choose to make directly to us rather than through the employer offering the pension scheme. You might do this because you are no longer employed by them. |

Other changes and considerations

We will provide information documents (known as KIIDs or KIDs) for underlying funds on PlanViewer, if they are available. These will give you greater transparency, by providing more information about the investments. They will be displayed alongside the relevant investment factsheets.

We will be changing the Fidelity legal entities that use your personal information, but the data we collect, how we do it and our reasons for collecting it will remain the same. FIL Platform Solutions Limited (FPSL) will become the data processor of your personal information, replacing FIL Life Insurance Limited. We explain how we use your details in the new Your plan explained document and in our privacy statement.

We hope you won’t ever need to make a complaint, but if you do, you can read our ‘How we handle complaints’ leaflet. It is available at: retirement.fidelity.co.uk/contact-us/complaints.

Alternatively, you can get a copy by calling our Workplace Investing Service Centre or writing to Fidelity International, Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP.