Your financial wellness

Feel good with Fidelity

Feel good with Fidelity

What is financial wellness? Check your financial health Navigating uncertainty Women and Money

Life stages

I want to…

Register for PlanViewer

PlanViewer simplifies managing your workplace savings account. You can access your plan documents, useful tools and expert insights, and easily track your retirement goals – all in one place.

Before you start:

Please have the following information ready to set up your username and password:

- Your Fidelity Reference Number. You can find this in the welcome letter and annual account statements that we have sent you. See where to find it

- Your National Insurance number. You can find your National Insurance number on your payslip, P60 or tax letters. If you don’t have one, you can enter your Staff number, which is available on your payslip.

- Access to your preferred email address and mobile number so we can verify them to ensure the security of your account.

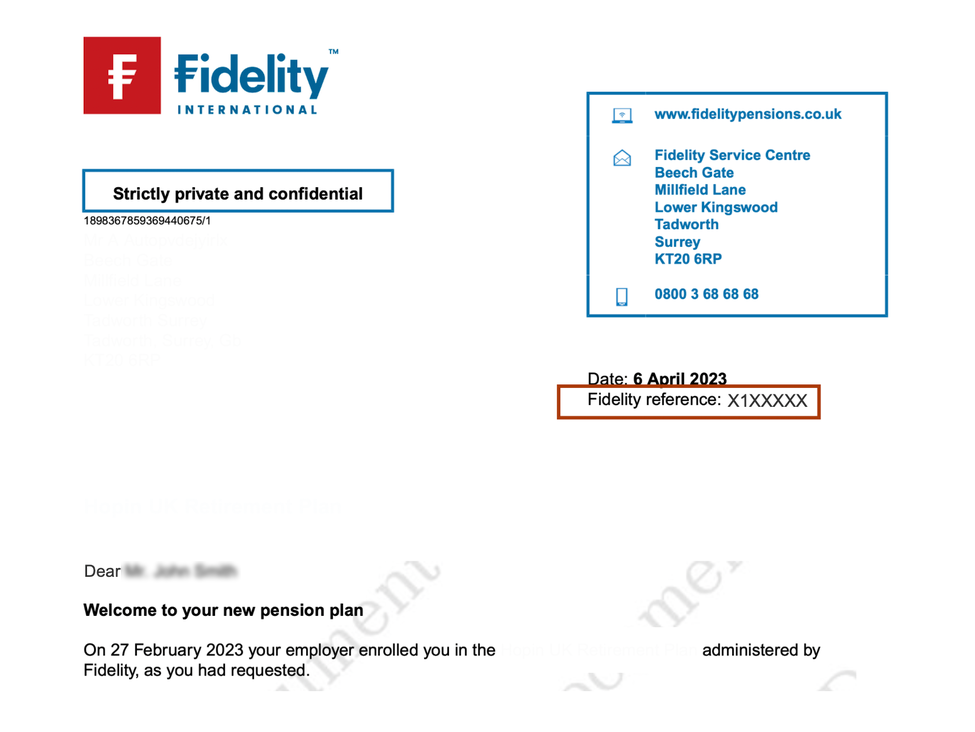

Fidelity Reference Number

It’s easy to locate your Fidelity Reference Number. You can find it on most of the official documents/paperwork you have received from us.

Find it in the welcome letter or your annual account statement:

- Open the welcome email or any annual account statements that we sent to you.

- Click on the attachment to view your Fidelity Reference Number, placed in the right-hand corner of the document.

See the screenshot below for guidance:

Policies and important information

Accessibility | Cookie policy | 2023 Corporate Sustainability Report | Diversity, Equity & Inclusion Reports | Financial crime | Governance | Legal information | Modern slavery statement | Privacy statement | Regulators and regulatory disclosures | UK tax strategy | Whistleblowing programme | Mutual respect policy

This information is not a personal recommendation for any particular investment, you are responsible for deciding whether an investment is suitable for you. In doing so, please remember that past performance is not a guide to future performance, the performance of funds is not guaranteed and the value of your investments can go down as well as up, so you may get back less than you invest. When investments have particular tax features, these will depend on your personal circumstances and tax rules may change in the future. You should regularly review your investment objectives and choices and if you are unsure whether an investment is suitable for you, you should contact an authorised financial adviser.

This website is issued by FIL Life Insurance Limited. Authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. Registered in England and Wales No. 3406905, Beech Gate, Millfield Lane, Lower Kingswood, Tadworth, Surrey, KT20 6RP. Fidelity, Fidelity International, the Fidelity International logo and the F symbol are trademarks of FIL Limited.

© FIL Limited 2026